The Kelly Criterion, Expected Value, and When Investing Becomes Gambling

I love going to Las Vegas.

When I was younger, I was enamored by the glitz and the glamour. All the flashing lights and exciting shows.

And, of course, there was the gambling. I was never a big gambler but it was fun to be part of that excitement.

As I’ve gotten older, I’ve come to like gambling less and less. It’s because I realize now that Las Vegas is about entertainment. Nearly every single bet is in the casino’s favor and so you’re just paying them to be entertained.

To get that rush.

As someone who doesn’t feel that rush too acutely when I gambled, all I could think about was how every bet had a negative expected value.

But that is the Vegas trade – you pay the casino a small edge and get the rush as entertainment. Sometimes you win big, sometimes you lose small for a long time, but you get the rush with each bet.

When you’re on vacation, that’s wonderful. It’s fun. I’m all for it.

But it’s important to keep that for vacation – you shouldn’t do it when you’re at home.

I’m going to share with you two gambling concepts – Expected Value and the Kelly Criterion – and then explain how to make sure that you aren’t gambling when you should be investing.

Table of Contents

What is Expected Value?

In a bet, expected value is how much you expect to get after each outcome.

Mathematically, it’s the weighted average of the outcomes.

In a coin flip, the expected value is 0. Half the time you win, half the time you lose, the expected value is zero.

You only want to play games in which you have an expected value greater than zero – which means you have an edge.

If you want to win more than you lose, you don’t want a fair fight.

You want positive expected value bets.

What is the Kelly Criterion?

The Kelly Criterion is a formula for calculating the size of your bet to maximize your winnings over time. The idea is that there is a correct size of bet for your bankroll and the odds. You don’t want to bet too much or bet too little.

If you know the odds of a wager, then the Kelly Criterion is this equation:

f = p – (q / b)

- f is the fraction of your bankroll to bet

- p is the probability of a win

- q is the probability of a loss (1 – p)

- b is the proportion of the bet gained with a win (if you bet $10 and win $20, then b = $20 / $10 = 2)

The equation gets a more complicated with more complicated scenarios – like if you make a bet and don’t lose the whole bet (as may happen with investments). Or if you make a bet and there are multiple outcomes (like rolling a dice). There’s a really good writeup of the Kelly Criterion by Christian Aichinger with a ton of math.

You don’t need to know the equation and the math to learn the lessons from this proven formula.

You only take positive expected value bets. If the odds are 50-50, the Kelly Criterion says that you bet nothing! If the odds are against you, you’re supposed to bet against yourself! (take the other side of the bet)

That’s it – that’s the key learning from a proven formula on how to maximize wealth through these bets.

Like it or not, math underpins everything we do.

You may think that betting is something reserved for steamboats and cigars, but it’s all math. In fact, it’s more concrete math than many other things in life because in gambling the rules are set. A coin has two sides, a dice has six, and a deck has 52 cards. Whether football team A will beat football team B has far more factors.

The same can be said for investing.

How This Affects Investing?

The basic concept behind these two ideas is that you need to make positive expected value decisions. In the long run, your returns will be an accumulation of these bets.

This is why casinos always make money. The house always wins.

When it comes to investing, it’s easy to think you are making a positive expected value decision when you’re just gambling.

Whenever you invest in an individual stock, unless you have insider information, you are not making a positive expected value decision. You need an edge and your edge isn’t “more research” or a “hunch.”

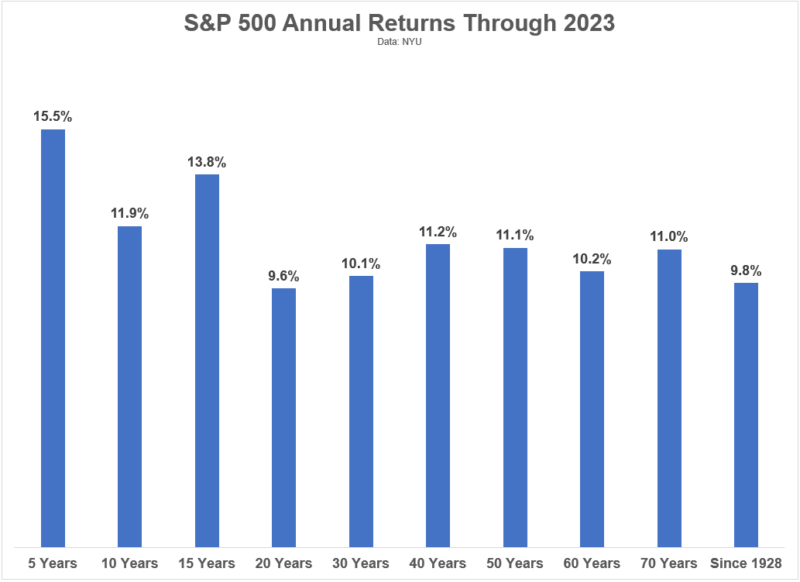

This is why many experts recommend that you invest with low cost index funds. You get the entire market for a very low price.

With index funds, your edge isn’t information. It’s time.

With a long enough time horizon, your investments will not only gain in value, the returns will exceed inflation.

And, with a low cost index fund, you’re paying practically nothing. Vanguard 500 Index Fund (VFIAX) has an expense ratio of 0.04%. That’s just $4 for every $10,000 invested. Fidelity 500 Index Fund (VXAIX) charges you even less, 0.015%, or $1.50 for every $10,000 invested.

And index funds are exactly the level of excitement you want in an investment – zero!

You get no fun!

(Except when you look at it in ten or twenty years and it has risen in value 🤗)

Yes, buying shares of Gamestop or Tesla or [insert hot stock ticker here] is exciting but you are not making positive expected value bets.

You’re paying for the chance to participate the excitement of owning those shares – in other words, you’re gambling.

You’re treating the stock market like a casino and you aren’t even getting free drinks, rooms, or show tickets.

Other Posts You May Enjoy:

HeyBenny Review: Maximize Your ESPP

Benny is a financial platform that helps employees of publicly traded companies maximize their Employee Stock Purchase Plan (ESPP) benefits. It advances the funds to employees with repayment plus fees due at the end of the participation period. But with fees and potential risks, is Benny worth the effort? And are there any alternatives? Find out in our Benny review.

8 Things to Know About Your ESPP

Employee stock purchase plans, or ESPPs, are a valuable employee benefit that some companies offer.

However, there are important rules, features, and tax implications to consider before signing up for your company’s ESPP. Here’s what you need to know.

Vanguard Sells Retirement Accounts to Ascensus

Vanguard has sold nearly all of its retirement accounts (except the SEP-IRA) to Ascensus. We use a Solo-401(k) at Vanguard so we break down what this changes looks like to us what we will do next.

What is an Interval Fund?

Interval funds are closed end funds that limited redemptions to set periods – this gives them the ability to invest in more complex instruments. But should you be investing in these types of funds?

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools,, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.